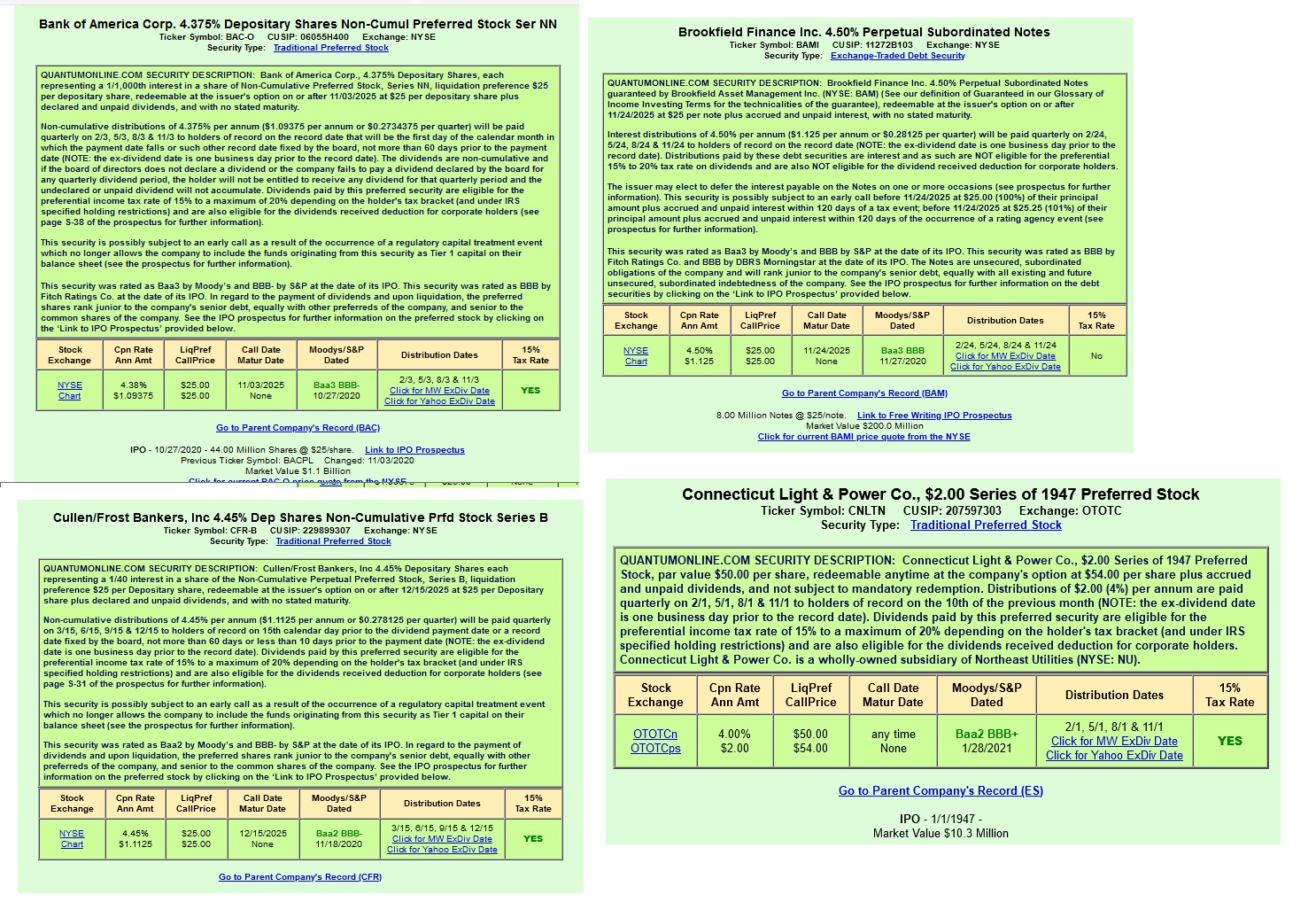

Hi Bosox, here are some investment grade preferred stocks (fixed income on a quarterly basis) that are currently below par. You would sit and hold these until they are called or they mature. You would only want to purchase them below par (they get called or mature at par). CNLTN is especially safe.

Tableplay, thank you for the thought of possibly holding some preferred stock. Currently, I do not trust the markets due to an unstable government that does not know what the fuck it is doing.

Last edited by BoSox; 03-02-2021 at 05:23 AM.

No problem Bosox. Generally, preferred stocks move according to interest rate changes (10 year treasury,30 year treasury rates) and are much less volatile than common stock. They are basically buy and hold (every 3 months you receive a fixed dividend for each share you own if the distributions are quarterly for example). For example, if the liquidation/par value of a preferred stock is $25/share then, when it is called away or matures you will get $25 per share you own regardless of if the current market price of the stock is below or above that value. Anyway that is just FYI, you should not take a position in them of course if you do not feel comfortable doing so.

Two quick trades for a K before getting out of bed, I went for half lots of just 250 sh each today because the market looked a little iffy but not too iffy, but my long terms are suffering today, including TSLA.

The idea is the keep trading and churn money into the account until, eventually, the long terms move up as well.

Last edited by MDawg; 03-02-2021 at 09:48 AM.

I tell you itís wonderful to be here, man. I donít give a damn who wins or loses. Itís just wonderful to be here with you people.

MDawg Adventures carry on at: https://www.truepassage.com/forums/f.../46-IPlayVegas

I tell you itís wonderful to be here, man. I donít give a damn who wins or loses. Itís just wonderful to be here with you people.

MDawg Adventures carry on at: https://www.truepassage.com/forums/f.../46-IPlayVegas

PM re-sent.

---

I toyed around with some AMZN orders, cancelled them all out, came back to one more TSLA trade @ 700 to 702, which makes it 1500. for today. Trading-wise. Long term TSLA and some of my other stocks are suffering a bit today, point wise. Dollar wise, down a lot more in my long terms than 1500.

I tell you itís wonderful to be here, man. I donít give a damn who wins or loses. Itís just wonderful to be here with you people.

MDawg Adventures carry on at: https://www.truepassage.com/forums/f.../46-IPlayVegas

Today was a little hectic. Not a lot, just a little.

First - the easy part. Scored 100 AMZN @ 3078 in the pre- and sold it quickly for 3088 soon after the bell. It actually went almost to 3108, but anyway, a K a day is the goal.

Then I bot another 100 at 3073, intending to sell at 3076 but it didn't quite get there (not much past 3074), and then collapsed. I averaged in another 100 @ 3041, and figured get the h. out at 3060, book 200. on that trade, and call it a day. It actually went all the way down to 3035 but I hung tough and got my fill.

So that's 1200 on AMZN, booked.

However, I am stuck in a 100 NFLX @ 537 which I am glad I played it very safe there as with NFLX I often buy larger lots. I have an order to average in more at 523 see if it fills, otherwise if it doesn't sell at 539 later today that will become a swing trade.

I had an order to buy 250 TSLA @ 581 which would have more than filled, but I cancelled it out after I got stuck in the AMZN trade. I generally try not to have more than one trade open at a time, and I was already in two. Actually that would have been a good trade too, as TSLA's at 691 and in the green now (after dipping to 673 !).

I hold additional shares of all of these stocks long term anyway.

Buying on dips is not dead. Averaging in is not dead. That's the way anyone should do it, trading or not.

Last edited by MDawg; 03-03-2021 at 09:16 AM.

I tell you itís wonderful to be here, man. I donít give a damn who wins or loses. Itís just wonderful to be here with you people.

MDawg Adventures carry on at: https://www.truepassage.com/forums/f.../46-IPlayVegas

Where is that drunkard? Why hasn't he stepped up to collect his $250K? More trades posted...alll winners...what are the chances these could all be genuine? With every additional trade I post a screenshot of isn't that more chance for him to salivate over beating me out of $250,000.? The offer stands open until the end of this month.

I tell you itís wonderful to be here, man. I donít give a damn who wins or loses. Itís just wonderful to be here with you people.

MDawg Adventures carry on at: https://www.truepassage.com/forums/f.../46-IPlayVegas

Dawg, you could bet a so-called AP a dollar, but, he won't take it unless it's already in his pocket. No getting it back, then.

Every one /everyone knows it all; yet, no thing /nothing is truly known by any one /anyone. Similarly, the suckers think that they win, but, the house always wins, unless to hand out an even worse beating.

https://youtu.be/OxgmMbSZ99w

Garnabby + OppsIdidItAgain + ThomasClines (or TomasHClines) + TheGrimReaper + LMR + OneHitWonder (or 1HitWonder, 1Hit1der) + Bill Yung ---> GOTTLOB1, or GOTTLOB = Praise to God! And, MHF.

Blog at https://garnabby.blogspot.com/

To be fair, the reason I am willing to put up $250,000. is because all my trades are genuine. So I suppose that might put me in the same boat of knowing that the bet is a lock.

However, I haven't been spending months claiming that these trades are fake or simulated, only to punk out when called on it. This is a legitimate wager I am just as serious about drawing a $250K cashier's check for this wager as I am about putting the same or more into any of these stock trades.

I tell you itís wonderful to be here, man. I donít give a damn who wins or loses. Itís just wonderful to be here with you people.

MDawg Adventures carry on at: https://www.truepassage.com/forums/f.../46-IPlayVegas

Every time someone says "To be fair" I always think its Tasha/Nathan posting.

To be honest (is that another Tasha expression?), I didn't realize that Garnabby posts anagrams until YESTERDAY. I finally clicked on one of those anagram URLs of his.

That's f'in brilliant! Odd. But brilliant. Didn't I mention John Nash the other day with regards to out-there REDietz?

I tell you itís wonderful to be here, man. I donít give a damn who wins or loses. Itís just wonderful to be here with you people.

MDawg Adventures carry on at: https://www.truepassage.com/forums/f.../46-IPlayVegas

To be honest, to be fair, rallying etc...... If anybody wants to have the dubious title of being her wannabe

I tell you itís wonderful to be here, man. I donít give a damn who wins or loses. Itís just wonderful to be here with you people.

MDawg Adventures carry on at: https://www.truepassage.com/forums/f.../46-IPlayVegas

Axel and MD are the new Arci and Singer.

I knew this one couldn't stay away. They drive 'em to me!

I tell you itís wonderful to be here, man. I donít give a damn who wins or loses. Itís just wonderful to be here with you people.

MDawg Adventures carry on at: https://www.truepassage.com/forums/f.../46-IPlayVegas

Got the 100 more of NFLX at 523, so now I am "stuck" in 200 NFLX @ average 530, looking to either dump at 531 today, or swing trade / hold. Not worried about that. Not much money tied in that trade and it'll come out fine soon enough. The chart speaks that NFLX will go much higher if not today, soon. If not, I have plenty of firepower to average in more or even do a huge buy of 1000 and dump all 1200 on another dip, if it does dip further tomorrow.

BUT I bot 100 AMZN at 3028, looking to sell at 3031, didn't quite get there and dumped to where I bot 100 more at 3009. Then dumped all the way down to...I think I saw 2995 ! print. Wow. Not good, but - looking at the chart AMZN hasn't been this low since, what? September? so I wasn't too worried.

Anyway, it worked out fine, sold the 200 @ 3019.5 so that makes it 1400 booked in trades today.

On the first pass it BARELY made it above 3019 then crashed again :-( to 3000. But on the second pass it took out 3020.

Last edited by MDawg; 03-03-2021 at 01:15 PM.

I tell you itís wonderful to be here, man. I donít give a damn who wins or loses. Itís just wonderful to be here with you people.

MDawg Adventures carry on at: https://www.truepassage.com/forums/f.../46-IPlayVegas

There are currently 1 users browsing this thread. (0 members and 1 guests)