Upping my game. Ha.

---> O, tell me the, tell me the list of "doped up" people out of left field who claimed to be a gambling messiah.

---> O! Gee, turn the other way. You are more.

My final, final anagram with gematria, https://vegascasinotalk.com/forum/sh...l=1#post171878

Upping my game. Ha.

---> O, tell me the, tell me the list of "doped up" people out of left field who claimed to be a gambling messiah.

---> O! Gee, turn the other way. You are more.

My final, final anagram with gematria, https://vegascasinotalk.com/forum/sh...l=1#post171878

First you wrote Then you wrote:

You're clearly lying about the value of your credit score, given that the highest possible score is 850: can't go any higher, i.e. into the "850's" as you claim (over 850}.

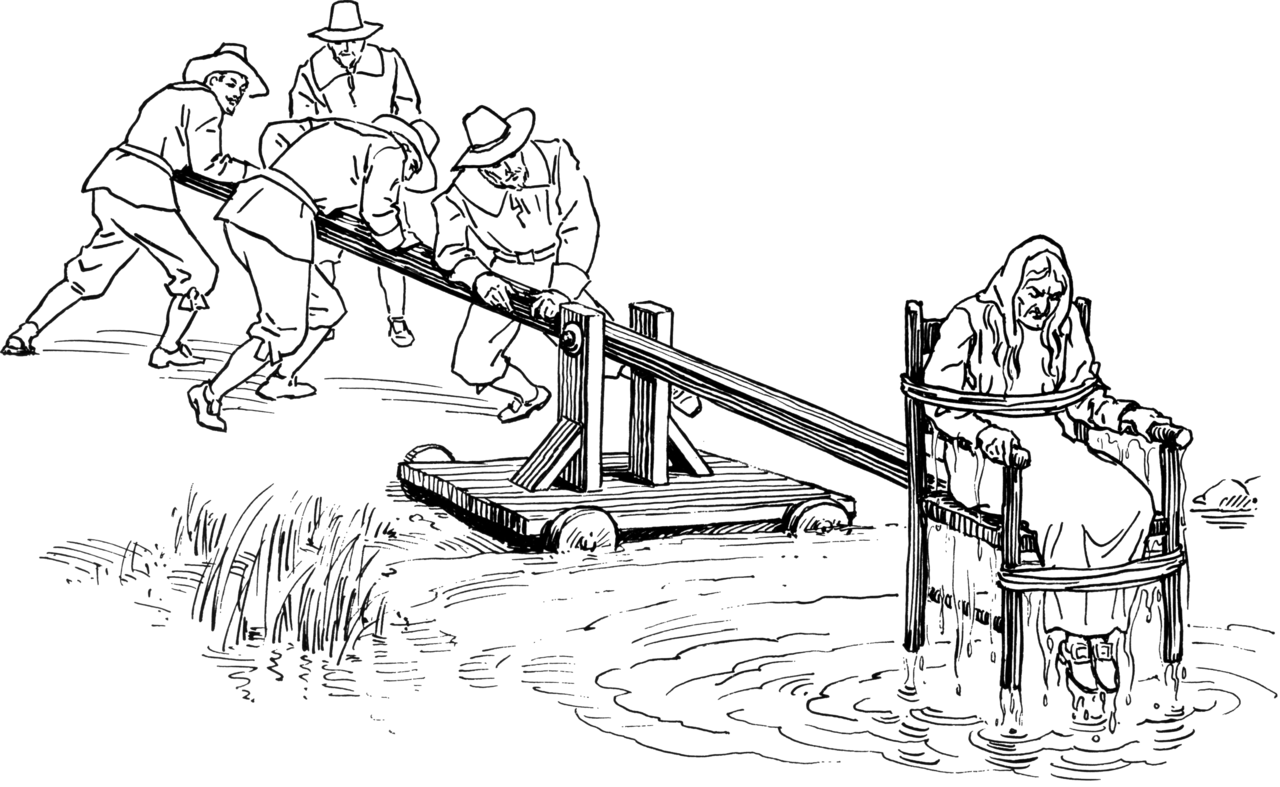

Caught in a lie...join the others on the dunking stool.

Last edited by MisterV; 02-10-2024 at 10:54 AM.

What, Me Worry?

Older model FICO scores used to go to 900 if I'm remembering correctly.

When I was able to actually login and look it said 832 and I realized it was a 850 point vs 900 point scale. 850/900 is actually worse than 832/850.

I said it was in the 850s which since isn't even possible wasn't a very good lie. That is what I remembered it being but when I was home and revisited this thread I logged in and gave the specific number.

Last edited by accountinquestion; 02-10-2024 at 12:32 PM.

LOL. Just look the crap up, guys. It's common knowledge, as they say.

The 900 scale is a rarely used alternative scale that incorporates auto loans and some bank loans. If you don't have an auto loan, you can't get bonus points, so the 900 scale is pretty much inappropriate. They tried to give people bonus points if they had current auto loans is what it amounted to. I have no idea if anyone actually uses the 900 scale these days. Maybe auto dealers.

To figure out what account's number likely is, just deduct the 50 points he garnered from having a specific auto or special kind of bank loan. If he thought he had 850-something, then he's somewhere between 800 and 810, which puts him a hair above mine and mickey's range, which is good, but not spectacular. I'm hoping for an 810 or thereabouts but may not get there.

Auto loans are a particular flag that companies like to see because they suggest you are willing to shell out long term money for depreciating items, and you are willing to pay for the opportunity to do so.

Some trivia: About 1 1/2 percent of Americans have perfect (850) credit scores.

Almost all credit scales run the 850 cap these days. Banks do when they are figuring real estate backed loans. Personally, I have never bought an automobile on credit, so I am never going to get a bonus 50 points so I can -- chuckle -- have a credit score "in the 850's."

Last edited by redietz; 02-10-2024 at 12:27 PM.

Here is the screenshot since Mr V accused me of lying. (Which TBH seems to be fair but for one, the value I gave wasn't even possible and secondly I corrected it ASAP and before anyone said anything.

I mean if you're going to lie get the basics right. I didn't get 3129 on the SAT for nothing, yanno?

IMO I guess financing my car helped. I don't have many credit cards. I regularly use a BOA one I got in the past few years because I get over 2% cashback I believe. (fluctuates with my status tier at the bank though. Which has been lower since BOA wants to stiff everyone on returns as a core part of their business model and thus I have not been keeping as much $ on there)

I also don't signup for new cards. I have on card for well over 10 years but it has a low rate.

I also declared bankruptcy at one point. A loan I had all at once had the terms changed on it. I could declare BR so I did. I then was part of a class action that won against the bank that did that. So ultimately I feel fairly justified in stiffing the banks. I'd rather have a BR than be some capitalists' bitch.

The last page or two is a perfect example of the fucked people on this fucked up forum.

EVERYTHING a pissing contest with you insecure morons.

Who fucking cares about your SAT scores from 50 years ago? Who fucking cares about tour credit scores?

Grow up you insecure little bastards.

Expected Value is NOT an opinion.

Lol SAT joke went right over your poor little pea-brain. My guess is Kewl never even took a SAT/PSAT.

I don't even care about my credit score. I didn't even know what it was when I first posted. On occasion I login to that website because I get "warnings". I then see the FICO score but paid no mind to it. (Why would I ?)

After Mr V claimed I lied (which I did albeit unintentionally) I went ahead and took the screenshot. It is 834 not 832 actually. I also admitted to a bankruptcy which is a shameful thing but... your point here is not to be accurate (and never is).. your point is to try and pump yourself up. After all it is *YOU* who is the incredibly insecure one.

Kewl, stop being such a loser.

Oh yea, and get help !

BTW The talk of credit scores is kinda interesting much like a discussion of anything else. I have no interest or need in one but it is a subject worth knowing about.

Now "tunnel credit" is a whole different subject and I won't make fun of YOU (Kewl) if you want to discuss it.

Yeah, but, then you edited out that you put the initial number out there as an "unknown", but, as in V's quote of you, you didn't put it out there as an "unknown". You really should have stuck to your first version. The second is even more sketchy. Ha.

I never had anything to do with SAT-type tests, so I can't speak from personal experience.

I was wondering that you called yourself that, but, then, that you, supposedly, had no money troubles.

1Hit1der

1Hit1der is online now

Gold

1Hit1der's Avatar

Join Date

Nov 2023

Posts

333

Upping my game. Ha.

---> O, tell me the, tell me the list of "doped up" people out of left field who claimed to be a gambling messiah.

---> O! Gee, turn the other way. You are more.

My final, final anagram with gematria, https://vegascasinotalk.com/forum/sh...l=1#post171878

Wait so now redietz is proposing that we modify AIQs credit score so that we can get his "true" credit score, which is really not that much more impressive than redietz' own?

As the Gen Zers say...what is going on here?

Upping my game. Ha.

---> O, tell me the, tell me the list of "doped up" people out of left field who claimed to be a gambling messiah.

---> O! Gee, turn the other way. You are more.

My final, final anagram with gematria, https://vegascasinotalk.com/forum/sh...l=1#post171878

The SAT scale is either 1600 or 2400 and even then there are different systems within the scale. I said I had a 31xx because it was never possible. The same way as saying I had a 850s on a 850 scale. It was a joke. fuck. Any American kid who was a college bound type will have some clue about SAT scores. I will try to not be so obscure for Garnabby and Kewl next time.

I'm not sure what your other point is but I don't really read your posts garnabby unless I see they involve me. I also don't read Kewl's posts when he tries to educate people. He never has any insight into anything and if he dips into personal experience there is absolutely 0 reason so believe it is based on his reality. You're a different version of that.

Dog me for the bankruptcy though. I gave you the bone. Not sure what your point is.. if the bankruptcy was anytime recently it would impact my credit score in a large way.

Bah I'm getting pulled into interacting with the neighborhood headcase over nonsense. I'll stop right here..

High school dropout can't even write, doesn't know the difference between affect and effect among other words, let alone then than, he probably took the PSAT in 10th grade before his family threw (or in his case "through") him out of the house and he dropped out became homeless ever since.

I'd guess UNKewlJ verbal score of at best 540. I'd tell you what my scores were but then UNKewlJ would just start softly whining again about how everyone is bragging about areas where he cannot compete (most homeless are blank credit scores, ghosts).

Originally Posted by Tater/Moses

I tell you itís wonderful to be here, man. I donít give a damn who wins or loses. Itís just wonderful to be here with you people.

MDawg Adventures carry on at: https://www.truepassage.com/forums/f.../46-IPlayVegas

I guess that you trying to explain your life, in a "positive light", even to total strangers on the internet, is really getting to you. One fuck-up after another. Ha.

Anyway, as I pointed out, I have no experience with the SAT-stuff, but, as I pointed out, months ago, I went through university on a full scholarship, based mostly on my grade-13 marks, which I posted up, and, my result on an international math contest.

Anyway, as I pointed out to you, long before, I couldn't care less who reads my stuff, nor what the ones who do, think about it. And, if you still think that it's possible to take the gematria stuff seriously, then I guess it's excusable that you thought that I took your supposed SAT scores seriously.

Total fucking moron. Do you have any friends on here?

P.S. Just, had a really funny thought. What when we are the only two posters remaining here? Holy cow!

Last edited by 1Hit1der; 02-10-2024 at 01:36 PM.

Upping my game. Ha.

---> O, tell me the, tell me the list of "doped up" people out of left field who claimed to be a gambling messiah.

---> O! Gee, turn the other way. You are more.

My final, final anagram with gematria, https://vegascasinotalk.com/forum/sh...l=1#post171878

It was never a supposed SAT score. It was a joke.

You didn't take my SAT talk seriously, you just took it serious enough to do some research and post it in a quote block. And that was for the joke..

but yea you are right. SAT might not even be a thing currently and many people had various ways to getting into college. Just for my age and many years around mine, the SAT was a very large component of where you could go to school so I assume people remember the scale of it.

More lies from gambling's biggest liar and bullshitter.

Not that it is any of your business, but I did well on the math and average on the English. I didn't care for English class much in high school. Probably skipped more classes that I attended.

But I did well enough to have been accepted at a private catholic university on Philadelphia's exclusive mainline. I only attended for one year. I didn't flunk out, just didn't care for college, had no idea what I wanted to do at that point. Sol I moved to the city (Phila) started working. I then found blackjack and went in a different direction. I always thought I would get back to it, even after moving to Vegas, but except for taking a few courses one year, I haven't. No regrets though.

But congrats to you Mdawg on that online college education. While I don't think you are the lawyer that you claim, I am sure it has come in handy.

Expected Value is NOT an opinion.

There are currently 1 users browsing this thread. (0 members and 1 guests)